KCU BORROWING SERVICE

MORTGAGES

Looking for your dream home or a second property – we can offer personalized mortgage advice and financing for what’s essential to you. KCU Mortgage Advisors can also provide advice on refinancing plans, line of credits and refer you to other KCU experts for additional banking needs.

Get advice however, wherever and whenever you want – in person, online, or on the phone.

Fixed Rate Mortgage

Our mission is to provide quality English language instruction.

Variable Rate Mortgage

Our mission is to provide quality English language instruction.

Mortgage Calculator

Our mission is to provide quality English language instruction.

Interest Rates Today

Our mission is to provide quality English language instruction.

KCU BORROWING SERVICE

LOANS

A KCU Personal Loan is a flexible borrowing solution that you can use to borrow money for a specific goal. You can use a loan to finance a renovation project, make a big purchase or consolidate your higher interest debts. If you're still deciding which lending option is best for you or the different ways you can use your loan or line of credit, our experts can help guide you.

Personal Loan

You borrow a fixed amount of money and agreed to pay it back over a period of time. You must pay back the full amount, interest and any applicable fee. You can make a monthly payment as installments.

Personal Line of Credit

KCU line of credit is a flexible loan from a financial institution that consists of a defined amount of money that you can access as needed and repay either immediately or over time.

Interest is charged on a line of credit as soon as money is borrowed.

Lines of credit are most often used to cover the gaps in irregular monthly income or finance a project whose cost cannot be predicted up front.

RRSP Loan

If you have short on cash and cannot contribute to RRSP, we are here to help you to provide RRSP loan. We have the flexibility to pay back whenever you want*.

*Terms Apply

KCU BORROWING SERVICE

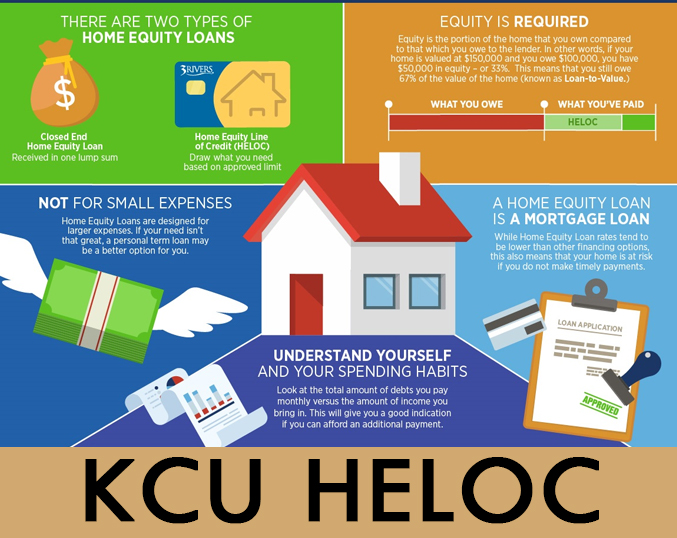

HELOC

KCU HELOC is an alternative to a mortgage. You get the option to borrow only what you need, as you need it. Plus, as it is secured by your residential real estate, you may get the benefit of an interest rate that is lower when compared to unsecured credit interest rates.

Home Equity Line of Credit

A home equity line of credit (HELOC) is a secured form of credit. The lender uses your home as a security that you'll pay back the money you borrow. Home equity lines of credit are revolving credit. You can borrow money, pay it back, and borrow it again, up to a maximum credit limit. For more info please contact our KCU experts.