KCU BOARD

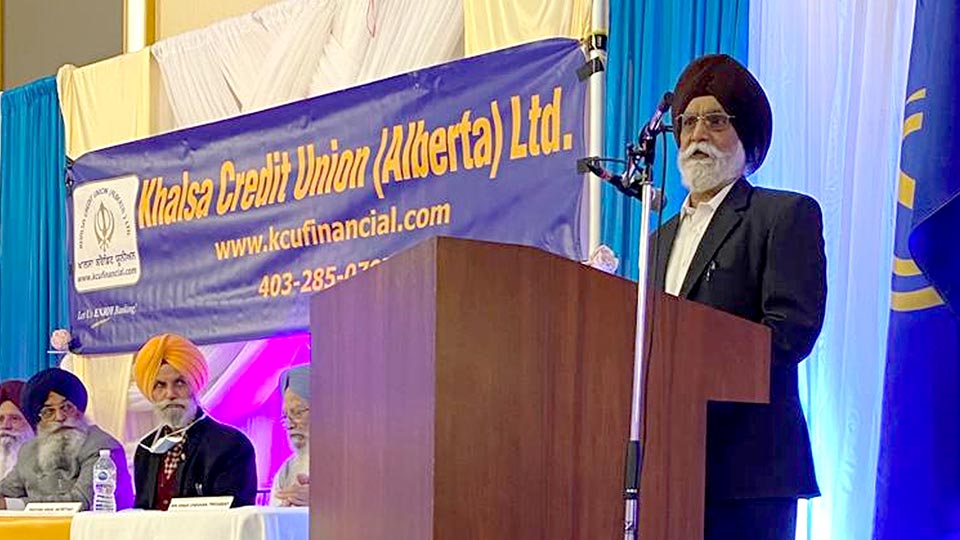

Annual General Meeting

Board has decided upcoming AGM Meeting for the year 2023 will be held on March 31st, 2024.

Financial Statement 2023

The financial statement for 2023 reflects our commitment to transparency, accountability, and sustainable growth.

WELLCOME at KHALSA CREDIT UNION

All about Wealth

Bring together all the parts of your financial life, and make your money work for you. By planning your finances, you are able to gain visibility into your future and are aware of the returns your investments should earn to achieve your goals.

27

Years Of Exprience

Years of Struggle

Better Strategy With Quality Banking

wonderful serenity has taken possession of my entire soul, like these sweet mornings of spring which I enjoy with my whole heart.A wonderful serenity has taken possession of my entire soul, like these sweet mornings of spring which I enjoy with my whole heart.

Request for Meeting

Find your convenient time and book meet with our finance experts.

I would like to discuss:

OUR BLOG

Read Latest Articles

KCU actively supporting communities in Calgary and serving exceptional service to individual and business customers.